TCOG lists 13 exemptions, exemption categories that need revision or elimination

Tennessee Coalition for Open Government recently provided the Open Records Ad Hoc Committee 13 exemptions or categories of exemptions that are interfering with the public’s right to know what government is doing.

“As you will see, many of the exemptions listed have problems related to overbreadth or vagueness that we suspect may exceed the public purpose of the exemption. We know that some of the considerations we are bringing forward were not part of the debate when the exemptions were passed by the legislature,” TCOG’s letter said. “While this list may not cover every exemption that impairs transparency in government, we wanted to give the committee a priority list that is manageable. We think a sunset provision going forward on new exemptions would provide a systematic way to review exemptions and how they are being applied in practice.”

The committee will meet for the third time at 1:30 p.m. Thursday in House Hearing Room III in the Cordell Hull at 425 5th Avenue. Its two previous meetings were Aug. 14 and Sept. 13.

TCOG earlier had given the committee seven recommendations to change the process of adopting exemptions as well as how to deal with current exemptions and news ones going forward.

Below is the exemption list sent to the committee.

Exemption Review Priorities – 2018

Compiled by Deborah Fisher

Executive Director of Tennessee Coalition for Open Government

September 19, 2018

1 – Investment records

There are two exemptions related to the confidentiality of investment records as they pertain to so-called “alternative investments” and private equity investments. (T.C.A. 49-7-165 and T.C.A. 8-37-104(a)(10)(B). The wording is slightly different in each exemption.

These exemptions shield information about investments made by the state’s retirement system and the University of Tennessee. They shield not only what the investment is (i.e., the venture or enterprise that is being invested in, or the nature of the investment), but also the exemption has been used to shield how much is being paid to the investment firm for making the investment. As we understand it, some of these investments may be in unregulated securities.

We believe this gap in transparency is wrong. The public deserves to know about the stewardship and investment of public money. And that principle should hold even when the money comes from a donation to a university, tuition paid by a student to attend a university or direct funding traceable to tax revenue. It is all public money, used by public institutions. Oversight and accountability of the government entity’s stewardship is effectively neutered without basic knowledge such as the service fees being paid and perhaps in some cases, the quality, effectiveness or risk of the securities being invested in.

These exemptions should be revisited to provide more transparency.

2 – Performance evaluations of government employees

There are at least four exemptions related to job performance evaluations that includes many state employees and local teachers. We believe the exemptions are vague in relation to reprimands, disciplinary action or even termination that might be part of a performance evaluation file.

For example, if an employee is reprimanded, is a record of that reprimand closed to the public as it might be considered part of a performance evaluation? If a person is terminated, is that letter of termination available even if it references performance? Is reprimand or disciplinary action information available for a government entity’s employees as a whole, as data, if such information is in individual performance evaluations?

We suggest clarification of the exemption to understand the Legislature’s intent.

The public purpose of the exemption — to create an environment for candid job performance evaluations — needs to be balanced with a need of accountability for the institution itself.

For example, is the institution adequately following up on complaints, particularly as they relate to safety of children in public schools, safety of employees, or the safety and rights of the public? Clarification about reprimands and disciplinary action could provide better accountability.

We also think there should be higher standards of transparency for top officials, such as presidents and chancellors of universities and colleges, and urge that performance evaluations of top officials be public.

With top officials, such as university presidents or chancellors, shouldn’t it be clear to the public the reasons behind both the hiring and firing decisions? Patronage should not play a role in these decisions. Transparency related to performance evaluations is a piece of that accountability.

The performance evaluation exemptions should be looked at together: (T.C.A. 10-7-504(a)(23); 10-7-504(a)(26); 49-1-606(b); and 8-30-313(d).

3 – Accreditation reports for public hospitals

T.C.A. 68-11-210 (b)(5)(C) allows health care facilities licensed by the Department of Health to meet licensing requirements if they have an accreditation report and letter from the Joint Commission on Accreditation of Hospitals. However, an exemption allows that accreditation report to remain confidential.

In 2016, the public hospital in Nashville (Metro General) received an emergency infusion of $10 million from Metro Nashville government to help address problems that had been identified in an annual accreditation report. However, the hospital authority refused to release the report based on the exception, although the report had been used as partial justification for the emergency $10 million.

We think this exception undermines transparency of public hospital operations that rely on public funding. Accreditation reports required by the state to satisfy licensing requirements should not be exempt. They reveal important information related to health entities licensed by the state, including any deficiencies, that the public has a right to know.

Likewise, any deficiencies in an accreditation report that could jeopardize the state license of private hospitals should also be public. This information is relied upon by the state to make decisions related to licensing and should not be withheld.

4 – Tax information

There are at least 6 exemptions related to tax information, and these should be examined together. However, the main one that is cited often to shield information is T.C.A. 67-1-1702. We believe the origination of this exemption was likely meant to keep information related to a person or business’s tax payment or tax return information confidential.

However, this exemption has been used to shield commitments made by state economic development officials to reduce a specific company’s tax (through a tax credit) as part of an economic development incentives agreement or initiative.

We think that if a government enters into an agreement with a company as part of an economic development incentives package, the public has a right to know the totality of the subsidy (in grants, tax credits, land value, etc…)

A business is not required to take such a subsidy from a government entity. But if a business entity chooses to take a subsidy from government, information about that subsidy should not be confidential.

The Commissioner of Revenue and Commissioner of Economic and Community Development have discretion to award and modify job tax credits and other tax credits to specific companies per T.C.A. 67-4-2109 by:

- lowering the otherwise required job numbers required to qualify,

- by lowering the period required for the company to make investments,

- by lengthening the time allowed to carry over tax credits,

- by waiving other requirements in law otherwise required receive tax credits, and

- by even authorizing additional other tax credits.

These are special “deals” made by two state agency heads and are NOT available to all businesses equally.

Because of the interpretation of the tax information exception, there is no public oversight of these deals and decisions, and no knowledge of the extent of these deals or who they are with.

5 – Investigative exemptions

There are numerous investigative exemptions for state agencies and entities.

We believe all of the investigative exemptions should be reviewed and the committee might find it helpful to review these as a whole to develop common standards.

Two investigative exemptions that concern us most based on the number of complaints we get are:

- The TBI investigative file exemption in 10-7-504(a)(2), and

- The local law enforcement exemption, which is not in statute, but has been determined by the Tennessee Supreme Court to be an exemption created by the Rules of Criminal Procedure, Rule 16, Discovery and Inspection.

TBI:

The TBI exemption is concerning because, unlike local law enforcement exemptions, the exemption lasts forever, even after an investigation or court case involving the investigation is finished. Members of the general assembly may have access to investigative records of TBI by resolution of either house or a joint committee of either house, or in compliance with a subpoena or court order.

We think this exemption is far too restrictive and hampers oversight and accountability of the TBI.

Local law enforcement investigative exemption:

The local law enforcement exemption created by the Tennessee Supreme Court’s interpretation of Rule 16(a)(2) of the Rules of Criminal Procedure (Discovery and Inspection) has been broadly applied by police and sheriff’s departments, and the state attorney general’s office, throughout the state.

Some law enforcement entities have used it to blanketly deny access to all offense or incident reports, while other law enforcement entities allow access to such reports. It depends on where you live in Tennessee on whether you can access incident or offense reports from a police or sheriff’s department. We believe that the immediate facts and circumstances of a crime, which is revealed through offense reports, must be available to the public.

Some agencies have abused this exemption to claim that records that are otherwise public records (e.g., state agency travel records, post-fire report and emergency management records related to the Gatlinburg fires) are confidential at the moment a law enforcement entity contemplates a potential investigation or opens an investigation that might utilize those records.

In the Gatlinburg fire, this is what happened. Even though the district attorney did not even know of all the public records that might be related to the response to the fire, he claimed all of them were exempt from disclosure because of his ongoing investigation / prosecution of two juveniles charged with arson. This caused normal records of fire responders, normal records of the city of Gatlinburg and normal records of TEMA related to the fire to be withheld for months.

The State Attorney General likewise has argued that travel records and phone logs of state employees — ordinary records created in the normal course of business by state agencies — became confidential when a Nashville district attorney opened or was about to open an investigation into the former acting director of TBI.

We do not believe that otherwise non-confidential public records of government should become confidential simply because an investigatory body decides to gather or view them as part of a criminal investigation.

The result is certainly a new way to keep public records from view by the public: All an investigatory body has to do is open an investigation and sweep those records into their file so that they are no longer public.

And in fact, this has happened in at least two high-profile cases:

- The Gatlinburg Fire (in which charges against the juveniles were dropped) and

- The investigation into the former acting TBI director (in which no charges were ever brought.)

We believe it is essential that:

- The Legislature review the TBI exemption so that the TBI’s investigatory file become subject to release under the public records act after investigation / prosecutions are completed – the same as in local law enforcement investigations.

- The Legislature state its intent through statute about what law enforcement records should be confidential during an ongoing investigation. And what records or information must be public to ensure transparency and to ensure accountability of law enforcement.

- We also urge the legislature to clarify and correct the exemption now being asserted by the state of Tennessee that non-confidential public records created by state or local government entities become confidential when an investigatory body contemplates or begins a criminal investigation and gathers or views those records as part of the investigation.

6 – Working papers / Audits

There are at least 13 statutory exemptions to the Tennessee Public Records Act directly related to audits of government entities, or audits of nonprofit entities regulated by or funded almost entirely by tax dollars.

Some of these audit exemptions have been used to hide from the public details of noncompliance and other flagged problems of government entities (both local and state entities). Additionally, the language repeated in some of these exemptions has been interpreted (we believe misinterpreted) to allow documents of a government entity that are otherwise public to become “nonpublic” when they become part of an audit investigation.

All of these exemptions need to be examined, preferably together, to develop a set of standards so that the public can know about the details of any problem findings with government entities. These exemptions are too easy to abuse.

Here is an example of the broad language in one of the audit exemptions, T.C.A. 4-3-304 (7) and (9). Working papers is defined specifically. Then working papers is also defined with an additional clause that says: “all other records relating to an audit or investigation by internal audit staff”.

An example of the effect: As reported to us, an audit conducted by the Tennessee Board of Regents concluded with a one-page report that said an agreement between a foundation and a foundation board member’s company was not disclosed and the benefits of the agreement did not justify the current cost. But the audit did not list the name of the foundation member or any details about the particular agreement. All other information, including the agreement, was withheld pursuant to the “working papers” exemption.

7 – Associations and nonprofits. T.C.A. 8-44-102 and T.C.A. 10-7-503(d)(1)

Some associations and nonprofits have been defined by law to be subject to the Tennessee Public Records Act. According to the law, they must meet 3 requirements that are outlined T.C.A. 8-44-102 (b)(1)(E)(i). Those requirements are:

- Must have been established for the benefit of local government offices, or counties, cities, towns or other local governments, or as a municipal bond financing pool.

- Must receive dues, service fees or any other income from local government officials or local governments that constitute at least 30 percent of its total annual income

- Be authorized under state law to obtain coverage for its employees in the state retirement system.

We believe this statute (8-44-102) should be updated to include any nonprofit whose funding comes almost entirely from local government entities. For example: those entities that receive all hotel-motel sales tax revenue of a government entity.

We also think the statute should allow for nonprofits established for the benefit of local government offices, or counties, cities, etc…. to be subject to the public records regardless of whether or not their employees are authorized to participate in the state retirement system.

This statute should also be amended to make clear that if a government entity transfers a governmental responsibility to a nonprofit entity, the nonprofit entity is subject to the public records act.

Also, 10-7-503 (d)(1) allows those organizations identified in 8-44-102 to avoid the obligations of the public records act if it has an annual audit. However, this is too low a bar, and along with aforementioned problems with details of audit findings, a gap is created where signifiant taxpayer money is being used to run organizations that have little or no transparency to the public. The allowance of an annual audit to replace the oversight created through transparency and accountability of the Tennessee Public Records Act should be eliminated. If these entities have specific records that must be shielded, tailored exemptions could be crafted for those purposes.

8 – Trade secrets, proprietary information

There are at least 16 separate exemptions related to trade secrets and proprietary information. There may be more.

As we have seen, some local government entities have entered separately into contracts with private entities that come up with their own definition of what trade secrets shall include. This should not be allowed. In addition to be completely contrary to the Tennessee Public Records Act, it is strangling local government officials, both elected and staff, who may wish to provide proper oversight and evaluation.

For example, a PILOT agreement that the Montgomery County IDB signed with Google defines that trade secret protection would apply to:

- The number of employees projected to be hired or hired to operate the project.

- The capital investment made by the company in the project that will be developed on public land.

- The relative proportion of real versus personal property invested (or any subcomponents thereof).

- The assessed value of either real or personal property as a component of the total assessed value.

That agreement also requires the Montgomery County IDB to:

- “(U)se its best efforts legally permissible in order to assist the Company in opposing” any enforceable order of a court to reveal that information. (i.e. requiring additional taxpayer dollars to be spent to fight a COURT ORDER if needed)

- Agree that the Public Records Act be construed in favor of non-disclosure. (i.e., in direct conflict with T.C.A. 10-7-505(e) which references that the Act be broadly construed so as to give the fullest possible public access to public records.)

- Not allow the IDB’s contract with Google to be attached to any public notice or presented for review in any public forum, or provide a copy or disclose the terms or conditions of it to any third party unless required by law or by order of a court.

- Not allow the IDB’s contract with Google to be disclosed as part of a press release or announcement.

- Require the IDB to notify Google within 48 hours of receipt of any public records request for documents related to the PILOT project, and if the IDB intends to fulfill the request, agree to give the company 30 days in which to seek a judicial injunction or restraining order; or redact anything the company defines as a trade secret.

Recommendation:

All of the trade secrets / proprietary information exemptions need to reviewed and updated so that such abuses as evident in this agreement cannot happen.

They also should be reviewed, and language inserted to clarify what the public is entitled to. For example, the public needs to be able to know the total amount of subsidy and value that governments are giving private entities.

No separate agreement should be allowed to be made that would prevent a government entity from measuring and sharing with the public the result of their public policy, such as by the number of employees hired or other measures considered important to the success of economic development initiatives.

In terms of businesses regulated by the state, the state should be allowed to make public detailed information concerning violation of such regulations, regardless of a trade secret or proprietary information assertion.

9 – Lottery CEO

A unique exemption in T.C.A. 4-51-124(a)(9) exempts all information and records relative to hiring or retention of the CEO of president of the Tennessee Education Lottery Corporation. We believe that records related to the hiring and retention of the CEO of this state agency should be subject to the same requirements under the public records act as any other top official of a state agency, and be open. We are not aware of any reason given for this exception at the time that it was passed.

10 – Student records

There are 16 exemptions that mention student records – students in LEAs and students in higher education institutions.

For example, 10-7-504(a)(4) allows student records to be treated as confidential. We agree with the spirit and specifics of this exemption: Records related to academic performance, the financial status of students or their guardian, any medical or psychological information and information such as this should be confidential. Student health records are also protected and rightly so.

Our concern with student record exemptions are when they are used to eliminate the accountability, transparency and oversight of the academic institution itself or the employees of that institution.

A common and repeated example of when there is overreach: complaints of school bus driver behavior, captured on bus video, and the video is withheld because students might be identified on the bus. This has happened even when parents of students want access. Entities have relied on various student records exemptions as justification for not releasing the video.

We think that records that relate to the safety and accountability of the institution should be public. Not only does the public have a right to know, but parents have a special interest and a right to know. Because these exemptions are often used — or misunderstood — to close records beyond academic and health records, we think clarification is needed.

We suggest looking at these exemptions together.

11 – Employees, identifying information

While we understand the privacy reasons to make certain employee information confidential, we believe there should be exceptions to the exception in some instances.

In 10-7-504(f), the home and personal cell phone numbers of government employees are confidential. However, we think that if a cell phone number is used regularly by a government official for government business, that this number should not be confidential.

The same exemption makes a personal, non-government issued email address confidential. We think any email address that is used by the employee regularly to conduct government business — whether it’s a personal email address or not — should not be confidential.

Making both of these changes make sense and also would save redaction costs.

12 – Vendor identity

The identity of vendors that provide the state goods and services used to protect electronic information processing systems, telecommunication and other communication systems, data storage systems was made confidential in recent years. My understanding is that this was made confidential because of concern that knowing the identify of a provider of a telecom system, or a information processing system, would give a potential hacker a clue about the type of system purchased by the government and cause a security issue.

Closing the identity of vendors to government is serious business in terms of accountability and the risk of cronyism and unfair patronage.

While there may be a security reason, there was no example cited during this bill’s legislative history of any time that any government telecom system or information processing system had been hacked after the identity of the vendor had been become known. There are numerous examples of government systems being hacked, but in all cases that we have been able to find, the security breach has never been associated with knowing the identity of the vendor. We were perplexed when this was passed with no evidence. Unless that evidence can be provided, we think this part of the exemption should be repealed and the identities should become public once more.

However, we do not think the entire exemption should be repealed, and suggest retaining the following part of the exemption, which we think is reasonable and sensible and allows enough discretion for adequate protection:

(A) Plans, security codes, passwords, combinations, or computer programs used to protect electronic information and government property;

(B) Information that would identify those areas of structural or operational vulnerability that would permit unlawful disruption to, or interference with, the services provided by a governmental entity; and

(C) Information that could be used to disrupt, interfere with, or gain unauthorized access to electronic information or government property.

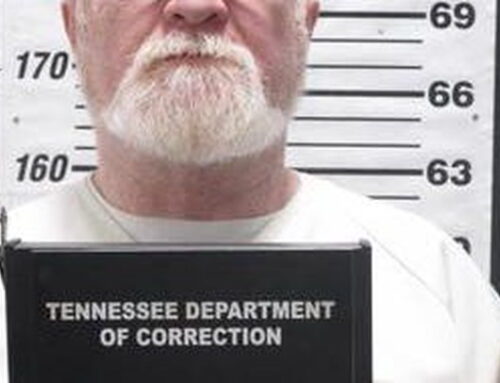

13 – Reports of violence within correctional facilities

An exemption allows a warden or chief administrative officer of a prison to have discretion to classify or maintain confidentiality of incidents of violence with correctional facilities if the release of the information would endanger or compromise security of any inmate or security of the institution.

The exemption does not have a safeguard against abuse, specifically “hiding” from the public incidents of violence for reasons other than inmate or institution security.

We believe this exemption should be re-visited to provide a safeguard to avoid coverups of violent incidents by or against guards, employees or inmates. Or the appearance of coverups.