The new Joint Open Records Ad Hoc Committee, formed to consider the growing number of public records exemptions, held its first meeting today.

The committee invited TCOG to make a presentation. Also presenting was Jason Mumpower, chief of staff for the Comptroller’s Office, which oversaw the compilation of a list of all statutory exemptions (which resides here.)

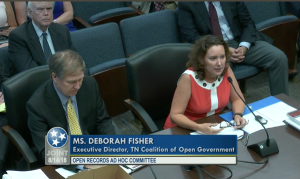

TCOG presents recommendations about a review of exemptions to the Tennessee Public Records Act at the committee’s first meeting on Aug. 14, 2018.

You can watch the entire committee meeting by clicking on the video link found here. My presentation starts around the 52 minute mark.

The committee set its next meeting for Thursday, Sept. 13, and invited members of the Advisory Committee on Open Government to speak.

Here are links to:

A printout of TCOG’s slideshow presentation

TCOG letter to Joint Open Records Ad Hoc Committee

Summary of TCOG’s recommendations (also printed below)

1998 report on exemptions by the Committee on Open Government (This is the last time exemptions to the public records act were reviewed — there were 89 exemptions at the time. We learned today, after the 2018 session this spring when 25 more exemptions were added, that there are now 563 statutory exemptions.)

2007-2008 report by the Joint Study Committee on Open Government, which included lawmakers and people appointed by lawmakers and the governor.

Summary of TCOG recommendations

Aug. 14, 2018

- Create a systematic Sunset Review by statute for all new exemptions.

- Create criteria in the law for examining exemptions during the sunset review and a process that allows public input.

- Improve the process and rules for new exemptions that:

- Ensures that members of the public and stakeholders have a reasonable chance to know when lawmakers are considering adding an exemption, beginning at the committee or subcommittee level.

- Allows members of the public and stakeholders affected by a proposed exemption a chance to be heard. Lawmakers should hear from more than the entity requesting the exemption.

- Ensures that the specific records being made confidential is clear and the impact is reasonably understood.

- Ensures that exemptions are drawn as narrowly as possible to shield the desired protected information, and not so broadly that the exemption can be easily abused to shield what should be public information.

- Ensures that any cost of adding an exemption (such as by requiring redactions of otherwise public documents) is included in a fiscal note.

- Considers routing any new exemptions through a standing or new committee or subcommittee that could consistently apply criteria and be familiar with the breadth of exemptions already in state law to avoid redundancy, conflicts and problematic vague language.

- Either create a sunset review process (see above) for all existing statutory exemptions or review current statutory exemptions for highest priority issues with remaining issues to be dealt with through a specified sunset process. Create a process to receive information from the public and stakeholders about highest-priority issues, including written comments and public hearings.

- Create a process to review exemptions that are not part of statute, such as the “investigative exemption” that can be misused to withhold what have long been routine public domain documents such as law enforcement incident and offense reports.

- Consider how the cost of copies and unreasonable delays in fulfilling public records requests blocks access to information in the public interest and develop better enforcement mechanisms within the law.

- Consider better and more regular use of Advisory Committee on Open Government to study issues as a way to regularly convene stakeholders to develop solutions and identify problems.

We also highlighted a few exemptions in our presentation as examples of problem exemptions. (not an exhaustive list)