UT uses new exemption to keep confidential how much it pays investment, hedge fund managers

Daniel Connolly wrote today in the Knoxville News Sentinel about how the University of Tennessee lobbied for a public records law exemption that is now being used to hide how much the public university pays hedge fund managers.

Doesn’t seem quite right, does it?

Doesn’t seem quite right, does it?

Connolly, a reporter with the Commercial Appeal in Memphis, did a story about the rising amount of endowment money that public colleges are pumping into private equity funds and alternative investments — mostly hedge funds — often in offshore accounts. The University of Tennessee system has $345 million in such funds, about 38 percent of all of its investments.

From the story:

Under the new law, the university still must disclose basics such as the name of the fund and the amount of money in it. But it doesn’t have to disclose the fees the managers charge, or the specific companies in which the funds are invested, unless the managers agree.

Under the exemption passed by lawmakers in 2017, only “the name of an alternative investment, the name of an alternative investment manager, the amount invested in the alternative investment, or the most recent fiscal year-end value of an alternative investment shall be open to public inspection pursuant to title 10, chapter 7, part 5.”

Everything else is confidential if:

“(A) The records contain confidential information or information that could be commercially reasonably expected to be kept confidential when provided to or by the public institution of higher education, or any analysis or evaluation of an alternative investment by the public institution of higher education; or

(B) Disclosure of the records reasonably could have an adverse effect on the public institution of higher education’s investment program, the value of an alternative investment, or the person or entity that provided the information for or to the public institution of higher education.”

Essentially, in practice, this means that the university is letting the investment manager decide what’s public and not public about UT’s investments, including how much they get paid.

So how did lawmakers come to think this was a good idea?

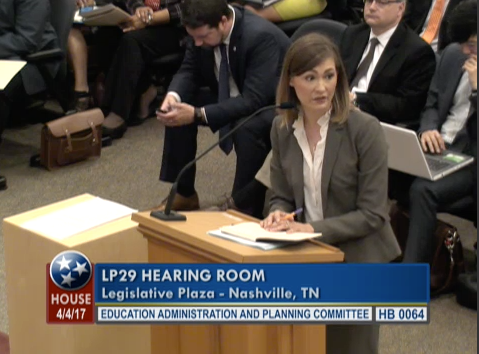

In an April 4, 2017, House Education and Administration Committee meeting, Carey Whitworth, the lobbyist for University of Tennessee, told lawmakers that the university needed the exemption because they were excluded from an investment because an investment manager could not live with the terms of our public records laws.

There’s video, and you can watch it yourself here: video of House committee passing investment exemption.

Two lawmakers raised questions about the bill, Rep. Roger Kane, R-Knoxville, and Rep. Craig Fitzhugh, D-Ripley.

Kane asked if the bill was going to be re-referred to the insurance and banking committee. “We’re talking about high finance here, we’re talking about giving privacy to organizations who are investing the money (for) higher ed. And I understand proprietary (information), but I just don’t know that this committee has that much expertise in high finance. But maybe we believe we do.”

The chairman of the education committee who also was the bill’s sponsor, Harry Brooks, R-Knoxville, answered that he would check with the chairman of the insurance and banking committee.

Here’s a part of the rest of the exchange, which included testimony from the UT lobbyist:

Craig Fitzhugh, D-Ripley: “What are we doing here? We’ve got a public university making decisions based on public funds and funds that have been given by individual (donors), and we’re keeping it confidential?”

Brooks: “These are private funds that we are talking about for the sake of the record.”

Fitzhugh: “What do mean private funds?”

Brooks: “Donated funds.”

Fitzhugh: “I understand that. But when they are donated, they are donated.”

Brooks asks to go out of session to hear from University of Tennessee who asked for the bill.

Whitworth, the UT lobbyist, thanks Fitzhugh for his questions and offers assuring words: “The bill still requires disclosure of the name of the fund that we’re investing in, the name of the investor that we are working with and the year end value of that investment. But it exempts things that could reasonably be considered proprietary. If we’re working with a third-party investor for example, their investment analysis, the research they’ve done on an investment so that information is not discoverable to a competitor.”

Fitzhugh: “Can you give me an example?”

Whitworth “…I have associated general counsel (Catherine) Lane here. She’s worked on an investment where (w)e were actually excluded from an investment that we believe would have been beneficial to the university where the investment manager believed these weren’t terms they could live by and we were excluded from participating in that investment.

Fitzhugh: “I don’t want to belabor the point. There are other investments if this one doesn’t work, is what I’m saying. I just don’t know that we’ve done this before to privatize information about investments (of donations) to universities once they’ve been made.”

The bill was sponsored in the Senate by Senate Education Committee chairwoman, Dolores Gresham, R-Somerville, where it received no opposition.

Keeping taxpayers in the dark is ‘completely appalling’

Connolly’s story quotes a professor who studies college endowments, who clearly thinks the secrecy is a bad idea:

“I think as a public university that relies partly on taxpayer money and donor money that is being funneled to these managers, I think that’s just unacceptable,” said Thomas Gilbert, a finance professor at the University of Washington in Seattle who studies endowments.

Rip Mecherle helps manage UT’s endowment as chief investment officer. He said he personally sought the new state law and that outside fund managers wanted it.

“There are managers who won’t work with people that don’t have these (rules) in place,” Mecherle said. “And as you can imagine, if the managers can afford to be choosy, they’re probably pretty good.”

Gilbert says managers fear they’ll lose business if the public knows the high fees they charge. He imagines managers telling institutions like UT that they’ll deliver the “awesomest” performance.

“And the money goes into the ‘awesomest’ fund, and lots of money goes to the manager to build his beach house or her beach house,” Gilbert said, “and the taxpayers are not aware of it. I think this is completely appalling.”

The caption bill technique

The bill was filed as a caption bill, meaning the original bill had unrelated language that was a placeholder for an intended amendment later in the process. Caption bills — so-called because they open up a “caption” of the Tennessee Code — can be difficult for the public to track for two reasons:

- The summary of the bill and the bill often have little to do with the intention of the lawmaker and is completely changed when it is amended later.

- The amendment is not made visible on the state’s online bill tracking system until it is passed by a committee. In other words, members of the public would not have access to the amendment until after lawmakers voted in committee, unless they knew to ask for it from the bill’s sponsor.

Here is the entire exemption:

49-7-165. Protection of records related to alternative investments.

(a) The general assembly finds a public necessity in protecting specified records relating to the investment program of the state university and community college system and the University of Tennessee system.

(b)

(1) Records of the state university and community college system and the University of Tennessee system relating to the name of an alternative investment, the name of an alternative investment manager, the amount invested in the alternative investment, or the most recent fiscal year-end value of an alternative investment shall be open to public inspection pursuant to title 10, chapter 7, part 5.

[Effective until July 1, 2021.]

(2) Notwithstanding subdivision (b)(1), records relating to the University of Tennessee’s or the state university and community college system’s review or analysis of any alternative investment or any investment therein shall not be open to public inspection pursuant to title 10, chapter 7, part 5, if:

(A) The records contain confidential information or information that could be commercially reasonably expected to be kept confidential when provided to or by the public institution of higher education, or any analysis or evaluation of an alternative investment by the public institution of higher education; or

(B) Disclosure of the records reasonably could have an adverse effect on the public institution of higher education’s investment program, the value of an alternative investment, or the person or entity that provided the information for or to the public institution of higher education.

(3) Subdivision (b)(2) shall be repealed on July 1, 2021.

(c) For purposes of this section:

(1) “Alternative investment” includes, but is not limited to:

(A) Any investment requiring an investor indicate if the investor qualifies as an accredited investor under Regulation D of the Securities Act of 1933 (17 CFR §§ 230.500, et. seq.);

(B) Unregistered securities or funds offered under exemptions provided by 17 CFR 230.144(A), 15 U.S.C. § 80a-3(c)(1), or 15 U.S.C. § 80a-3(c)(7); or

(C) A qualified purchaser under 15 U.S.C. § 80a-2(a)(51); and

(2) “Public institution of higher education” means the University of Tennessee or the state university and community college systems.

(d) Nothing in this section shall limit access to records by law enforcement agencies, courts, or other governmental agencies performing official functions.