New ‘proprietary’ exemption would shield data about state insurance plan

A proposed public records exemption would make confidential “all proprietary information” received by the state from its health insurance contractors, including but not limited to information or data about reimbursement rates paid through the state’s self-funded employee health plan.

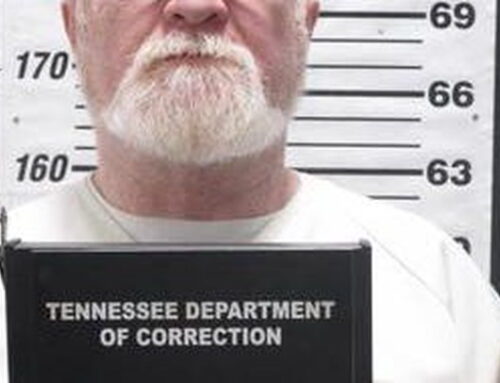

Access to information showing the disparities in payments to health care providers for the same services became an issue in 2019 when then-state Rep. Martin Daniel of Knoxville sought to get data to see if the state was reaping savings it should.

After Daniel sought the information, the three large health care companies who contract with the state to administer the state’s employee health care plan — BlueCross Blue Shield of Tennessee, Cigna and Optum — filed “reverse public records” lawsuits to prevent the Department of Finance and Administration from releasing payment information.

HB134, sponsored by state Rep. Pat Marsh, R-Shelbyville, is scheduled to be heard at 5 p.m. Wednesday in the House Public Service Subcommittee. The Senate companion bill, SB169, is sponsored by state Sen. Jon Lundberg, R-Bristol.

The bill, which amends Title 7, Chapter 27 related to group insurance for public officers and employees, states that “[a]ll proprietary information, including, but not limited to, provider reimbursement, provided to the department of finance and administration division of benefits administration, or any successor entity operated by this state for the purposes of administering plans authorized by parts 2, 3, or 7 of this chapter, or any successor plan or program, are confidential and not subject to the disclosure under the public records requirements of title 10, chapter 7.”

Parts 2, 3 and 7 deal with group health and life insurance for state, school and local government employees.

The bill does not define “proprietary” — or what would not be proprietary under the exemption, effectively leaving the decision up to the company.

The use of proprietary and trade secrete exemptions to the public records law has been a growing problem. Private companies have used proprietary and trade secret exemptions to keep confidential information about their contracts with the state, including how much the government has paid as part of the contract.

A review in 2018 by TCOG revealed at least 16 separate exemptions that make otherwise public records confidential using the proprietary or trade secret exemption. That same year, TCOG, along with other open government advocates, urged an Open Records Ad Hoc Committee to review and update the exemptions, adding clarity to ensure they don’t hide information relevant to public oversight and accountability. The committee did not take action.

A bill sponsored by Daniel in 2019 would have limited the ability of businesses to claim a government payment to them was confidential under a proprietary or trade secret exemption. But the bill failed in the House Public Service subcommittee.

The proprietary and trade secret exemptions are powerful because they are so broad and preemptive, and often come down to the company’s interpretation. Often a state or local government will not release information under a public records request if a company says that the information is a trade secret or proprietary, leaving the requester in a position of having to go to court to prove why it’s not.

Many companies also include non-disclosure clauses in their contracts with the government that require notification and delay of release of information in their contracts.