Legislature invigorates campaign finance reporting, ethics rules

The Tennessee General Assembly strengthened rules on campaign finance and ethics reporting today in legislation that the House speaker has described as bringing money flows “from the dark into the light.”

The legislation will increase the information available to the public, including on the state’s website, and tighten down loopholes used to undermine accountability.

While the bill is comprehensive and touches many parts of state campaign finance and ethics statutes, its sponsors suggested that even more should be done and additional legislation could be coming next year.

Lt. Gov. Randy McNally and House Speaker Cameron Sexton — the top leaders of each chamber — championed the legislation, fighting off protests from some nonprofit groups that, for the first time in Tennessee, will have to report spending on communications above an aggregate of $5,000 “that expressly contain the name or visually depict the likeness of a state candidate in a primary or general election” 60 days prior to the election.

“Openness and transparency in the political process are prerequisites to freedom. For too long, shadowy political operatives working for special interests have been allowed to exploit loopholes in our system and operate in darkness,” said McNally, who has served in the General Assembly since 1979 and whose legacy includes fighting corruption in the 1980s when he wore a wire for the FBI to expose vote-buying during Operation Rocky Top.

“If you are attempting to influence the outcome of an election Tennessee, the voters deserve to know who you are and what you are doing. Now they will.”

“It’s all about transparency and it’s about accountability,” Sexton said in describing the bill earlier this month in the House Local Government Committee. “The voters of Tennessee, when you watch all different elections, they want more transparency in campaign finance. They want to know who’s behind the money, how they’re spending the money, because they’re trying to influence an election.”

The bill adds new provisions to the statutes governing campaign finance disclosures, conflicts of interest and the two main governing bodies that enforce the laws, the Tennessee Registry of Election Finance and the Tennessee Ethics Commission.

The final version of the bill emerged Thursday morning on the last day of the session after a conference committee met to work out differences (see video).

Nonprofits will now have to disclose spending over $5,000 in state races

The biggest outcry on the bill came from nonprofits organized under the IRS Code 501(c)(4), (5) and (6) who will now have to report certain spending.

These types of organizations, unlike nonprofits organized as 501(c)(3)s, are allowed by federal law to engage in political campaigns on behalf or in opposition to candidates or referendums. But they’ve not had to report spending related to political campaigns in the same way as political action committees. Some have referred to this spending as “dark money.”

Intense lobbying against the bill from these groups resulted in additional language that distinctly states that those organizations only have to report qualifying expenditures, not contributions. Though the original bill never required reporting contributions, the groups feared that the language might somehow be interpreted that way later.

The bill was also changed to say that spending on communications about candidates to the organization’s members or “any person who has expressly consented to receiving communications from the organization” do not count toward the $5,000 triggering disclosure.

The bill also excludes communications made prior to, but still available during, the 60 day-period, and communications with lawmakers or the executive branch during a legislative session if it happens to fall within 60 days of an election.

The final bill also confined the expenditure reporting to communications about candidates in state races — the earlier version included local races.

More reporting during 10 days before election, referendum

The bill closes a gap in current law to require timely reporting of campaign expenditures. Currently, the last report required by candidates and PACS is 10 days before a primary, general, runoff, special election or referendum. This allows much of the spending on advertisements to happen under the radar during what is often the most intensive period of campaigning.

Current law requires contributions to be reported during these 10 days — when a contribution exceeds $5,000 — but not expenditures.

The new legislation closes that gap and requires expenditures to also be reported, using the same thresholds.

While the threshold remains $5,000 for statewide races, like the governor’s race, it was reduced to $1,000 for state representative and local races and $3,000 for state senate races. However, the new law adds additional reporting for contributions, specifying that thresholds will apply to aggregate contributions, meaning, for example, multiple contributions of $900 by the same person or entity could not avoid disclosure.

Reports have to be detailed. They must include the amount, date and a brief description.

As before with contributions, they must be reported by the end of the next business day in which the contribution or expenditure was made.

The legislation also requires the Tennessee Registry of Election Finance to post the daily reports of contributions and expenditures to its website “as soon as practicable” and to establish an electronic system for filing the reports. The Registry of Election Finance handles contributions and expense reports from candidates for state office and publishes such campaign finance reports online along with other reports.

For candidates for local office, county election commissions must post reports “as soon as practicable” but only if the commission otherwise posts campaign finance reports to a website. Many county election commissions do not post campaign finance reports to a website, so in those counties, they would only be available to the members of the public if they ask for them.

More itemization of campaign finance reporting

Currently, when a candidate or PAC meets the threshold to have to itemize contributions and expenditures, only expenditures more than $100 have to be itemized. The bill now requires all expenditures to be itemized, showing the name and address and purpose of the payment.

Also, the trigger for having to file an itemized report of contributions has been changed. Current law allows unitemized reports if no contributions or expenditures during the reporting period exceeded $1,000. The new legislation now caps the amount of unitemized contributions to $2,000, meaning once the $2,000 in contributions has been reached, any contribution afterward has to be itemized by name, address, occupation and, when required, employer.

Disclosures required when paying state employees, officials for campaign services

Currently, the law requires any person or entity that hires state employees or members of a state board for consulting services to disclose it to the state ethics commission. Such disclosures become public records. The measure is designed to reduce the improper influence of government employees and members of state boards and commissions, such as regulatory boards.

The legislation expands such disclosures to include hiring those people for “campaign services.” Campaign services is defined broadly to include services to advise or assist a candidate, political campaign committee, affiliated political campaign committee or multicandidate political campaign committee in a state election and includes producing campaign work, paper and electronic advertising, producing mailers and fliers, and distributing mailers and fliers.

Importantly, if a person or entity hires or pays a fee or other form of compensation to members of the General Assembly or their staff for campaign services, this must now also be reported by the person or entity to the state ethics commission, with a copy sent to the Registry of Election Finance.

Other new disclosures required by law include:

- Disclosure of conflicts of interest expanded to lower court judges. Currently, annual disclosures of conflicts of interest have to be filed by appellate judges. The legislation expands it to chancellors, circuit court judges, criminal court judges and judges of all courts of record.

- Disclosure of PACs controlled by members of General Assembly or candidates. Adds requirement that candidates for or members of the legislature must disclose any PAC they control or have controlled in the previous five years.

Tightened accountability provisions

The bill also includes new provisions to increase accountability and closes some loopholes:

Civil penalties cannot be paid with PAC funds. A new provision makes the person who directly controls expenditures of a multicandidate PAC personally liable for any fines for violating campaign finance or ethics laws when the civil penalty is a Class 2 offense. The person would be prohibited from using PAC money to pay the fine. In a 2020 controversy, former House Speaker Glen Casada used campaign money held by his political action committee to pay a $10,500 civil penalty levied by the Tennessee Registry of Election Finance.

Segregation of personal and campaign funds. Campaign funds must be kept in a segregated campaign account and not co-mingled with personal property of a candidate. If a candidate is found in violation, the penalty is a maximum $10,000.

Retention of documents needed in an audit. Candidates, campaigns and political action committees are required under the new legislation to retain for two years a broader range of documents that includes any documentation that directly results from a financial transaction and other statements.

New penalties for false information on disclosure forms. A person who files false information on a disclosure form, such as a conflict of interest or income form, would be subject to a Class A misdemeanor, up from a Class C misdemeanor. Also, disclosure forms now must be signed under penalty of perjury.

Adds governor’s cabinet to those who are prohibited from consulting work. Extends an anti-bribery statute that prohibits members of the General Assembly, the Secretary of State, State Treasurer, Comptroller of the Treasury, the governor and the governor’s staff from “receiving a fee, commission or any other form of compensation for consulting services” to also prohibit members of the governor’s cabinet from receiving such fees. The penalty is a Class A misdemeanor and being forever barred from holding any state office, or a Class C felony if the conduct rises to bribery.

Identity of people involved in PAC. Requires multicandidate PACS to provide the Registry of Election Finance photo identification of each officer or person who directly controls expenditures and treasurer — the same types of identification as would be required to vote in Tennessee. The measure appears aimed at a scheme of Casada’s former chief of staff, Cade Cothren, who was discovered to have formed a New Mexico-based company Phoenix Solutions to do campaign services for candidates while hiding his identity.

Prohibits solicitations that trick contributors. Prohibits a candidate or political action committee who is soliciting funds from using forms with pre-checked boxes that would authorize future contributions through the donor’s credit card or bank account.

Transparency of election finance and ethics commissions

Requires settlements of large fines to be voted upon in open meeting. Requires the Registry of Election Finance and State Ethics Commission to vote in a public meeting on any settlement of assessed penalties against a person that exceed $25,000.

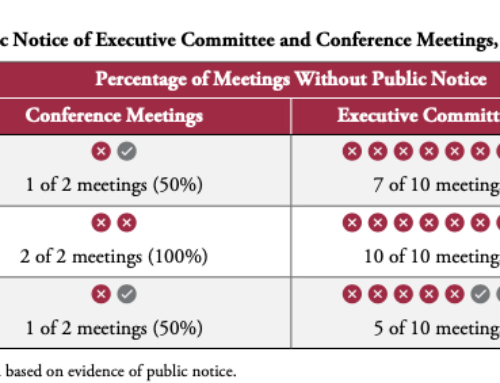

Notice of meetings. Requires that meeting agendas for the Registry of Election Finance and State Ethics Commission be published on the website five business days before the meeting. In the event of a special-called meeting, the agenda must be published on the website at least 24 hours before the meeting.

Timely information on websites. Requires campaign finance reports to be posted on the website as soon as practicable for the reports that must be filed daily during the 10 days before the election. Requires the Registry of Election Finance to develop an electronic filing system for such reports.

Changes appointment process for vacancies. Adds provisions for the House and Senate leaders to appoint new people to the ethics and campaign finance boards when a vacancy occurs.

New law comes during federal investigation

The bill comes in the midst of a federal investigation surrounding Capitol Hill. Already, one lawmaker, former Rep. Robin Smith, R-Hixon, has pled guilty to federal wire fraud charges in relation to a kickback scheme involving Cothren’s Phoenix Solutions. Controversy also has hounded former House Speaker Glen Casada who has been the subject of inquiry including over the management of his leadership PAC.

In addition to McNally and Sexton, the main co-sponsors of the bill were Sen. Ferrell Haile, R-Gallatin, and Rep. Sam Whitson, R-Franklin.

Others who signed on: Rep. Darren Jernigan, D-Nashville, Rep. Ryan Williams, R-Cookeville, Rep. Patsy Hazelwood, R-Signal Mountain, Rep. Sabi Kumar, R-Springfield, Rep. Eddie Mannie, R-Knoxville, Rep. Bob Ramsey, R-Maryville, Rep. Bill Freeman, D-Nashville, Rep. G.A. Hardaway, D-Memphis, Rep. Mark White, R-Memphis and Rep. Dan Howell, R-Cleveland.