Judge denies open records lawsuit against Haslam

By ERIK SCHELZIG, Associated Press

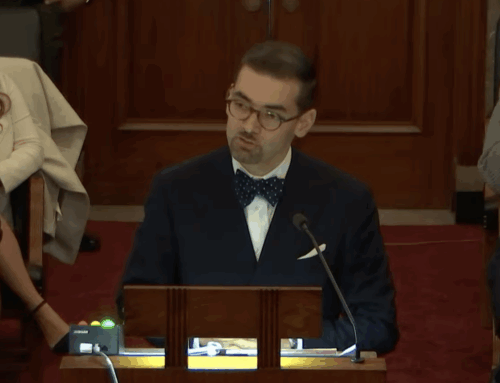

A tax attorney who sued for the release of records from Gov. Bill Haslam’s administration related to a $350,000 analysis of business tax collections in Tennessee said Tuesday that he likely will appeal a judge’s denial of his open records lawsuit.

Attorney Brett Carter had filed the lawsuit in chancery court alleging a “willful” violation of the Tennessee Open Records Act over the state finance and revenue departments’ refusal to disclose details about how they decided to draft the Revenue Modernization Act that Haslam has proposed to lawmakers this year.

But Chancellor Carol McCoy on Monday denied Carter’s lawsuit after reviewing some of the requested materials in chambers.

“It is disappointing that the state is attempting to pass tax increases based on a secret tax study,” Carter said in an email.

Haslam announced last year that he was commissioning a study of Tennessee’s revenue system to try to explain the volatility of business tax collections, but his lawyers said no single study was produced by the analysis and that other records were protected by an open records exemption for taxpayer-related materials.

The sweeping legislation includes taxing software and video games accessed remotely, and creating incentives for companies to distribute products in Tennessee. Legislative analysts project the proposal would raise $53 million for the state in the next two years, plus $7 million a year for local governments.

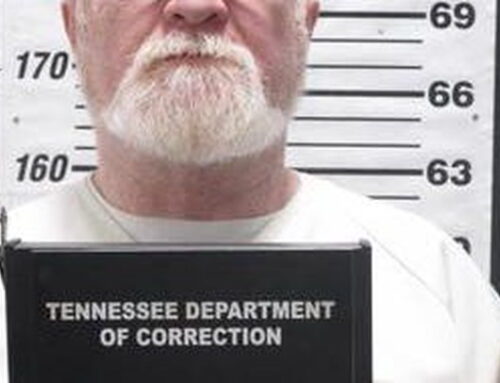

In an affidavit filed with the court, state Revenue Commissioner Richard Roberts said state law gives him wide latitude to decide to deny records requests based on what is “in the best interests of the state.”

Releasing documents related to studying the state’s tax system “would have a chilling effect on the department’s ability to engage in frank discussion about policy options, and in particular about policy options that could be unpopular with or opposed by various groups or industry segments,” Roberts said in the filing.

The commissioner said that those details could also be used to structure businesses to avoid paying state taxes.

Roberts added that the “information merely indicating that the governor had requested information about certain tax policies” could hurt the state’s chances of attracting companies to the state — even if those policies were ultimately rejected by the governor.

Roberts argued that the release of any individual document sought in the lawsuit could be taken out of context and presented in a way that “does not accurately represent the purpose of the study.”

Carter said he was disappointed with the commissioner’s decision to block the release of the documents.

“The commissioner concluded that it is not in the best interest of the state to have an open and transparent discussion about our state tax laws,” Carter said.